Introduction

The assignment of a contractual position in a Contrato Promessa de Compra e Venda (CPCV, or Purchase and Sale Promise Agreement) is a topic that generates many questions, especially when it comes to the impact on the Imposto Municipal sobre Transmissões Onerosas de Imóveis (IMT, or Property Transfer Tax). This article aims to clarify these doubts and provide a more detailed view on the subject.

Motivation

Many investors choose to buy properties off-plan, in new developments, with an expectation of appreciation of 10 to 20% - a typical appreciation obtained in recent years. In addition, there is the possibility of assigning their position to another buyer before the deed, obtaining a quick capital gain within 1 to 2 years.

Precautions to Observe

The possibility of assignment of position should always be validated with the developer. There are cases where the developer only authorizes the assignment of position when all other properties of the same type have already been sold. In addition, the developer may require that the current marketing price of that type be maintained.

Impact on IMT

If the developer authorizes the assignment of position and this clause is included in the CPCV (or in an amendment to the CPCV, signed later), the initial buyer is obliged to pay IMT immediately (before the signing of the CPCV / amendment), and subsequently whenever there are initial downpayment reinforcements, at a rate of 6.5%, i.e., the more favorable progressive rates are not applied, for cases of acquisition for permanent own housing purposes or secondary housing for rental (*).

The amount of IMT paid by the initial buyer is a cost of the operation and is not recoverable.

On the date of the assignment of the contractual position, the new buyer is subject to IMT calculated on the value of the assignment, applying the same rules referred to in the previous paragraph.

The amount of IMT previously paid (at the time of assignment) by the new buyer will be deducted with the total payment at the time of the deed (there with the application of progressive rates).

Note that the tax must be paid before the promise contract is signed and before the contractual position is assigned.

Practical Example

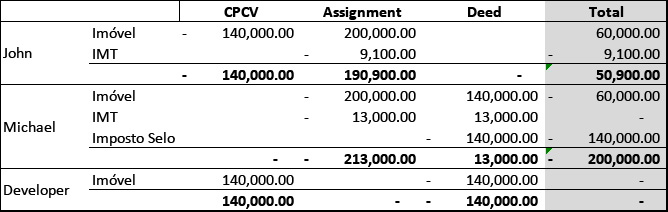

To illustrate better, let's consider the following example:

- John intends to buy a 3-bedroom apartment for the price of €750,000. He signed a CPCV (without an assignment of position clause) and paid €140,000 to the developer, as downpayment;

- After 1 year, John assigns the position, through an amendment to the CPCV to Michael, for the price of €200,000. At this date, John has to pay the IMT referring to the value of the downpayment already paid in the CPCV, i.e., €9,100 (6.5%*€140,000), and Michael pays the IMT referring to the value of the assignment of position, i.e., €13,000 (6.5% * €200,000);

- At the deed, Michael pays the remaining IMT. Assuming that the purchase is for permanent own housing (which at this value is indifferent since there is no difference between the tables of progressive rates for properties intended for own and permanent housing or exclusively for housing), the total amount of IMT to be paid would be €45,000 (6% of the transaction value). This amount will be deducted from the €13,000 paid previously at the time of the assignment of position, i.e., IMT in the amount of €32,000 will have to be paid. To the IMT is added the Stamp Tax at a rate of 0.8% of thetransaction value, i.e., €6,000.

John will have to indicate the assignment of the contractual position in the IRS annual tax form (€200,000 - €140,000 = €60,000), being taxed only for half of the capital gain (€30,000), given that he is a tax resident in Portugal, which will be added to the IRS income of that year and will be taxed at the general progressive rates.

Conclusion

The assignment of a position in a CPCV is a strategy that can be quite profitable for real estate investors in Portugal. However, it is crucial to be aware of the tax implications, namely the payment of IMT and IRS. It is always recommended to consult a duly qualified professional to ensure compliance with all tax obligations.

This article had the precious review of Dr. Maria Norton dos Reis from Pares Lawyers, who will be available to clarify any doubts. The simplification of technical terms and legal references is the sole responsibility of the author.

(*) Note: The Tax Administration has difficulty applying these rules and the procedure is not unanimous because these types of settlements depend on the employee of the Tax and Customs Authority (the information is entered manually): we are aware of settlements where tax was paid at the progressive rates provided for properties exclusively for housing (but not for own and permanent housing) and others where it was paid at the fixed rate of 6.5%, relating to properties not exclusively for housing.